|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

How to Apply for a Housing Loan: A Comprehensive GuideUnderstanding Housing LoansApplying for a housing loan can be a significant step in achieving homeownership. It involves various processes and requirements, which may seem daunting at first. However, with the right information and preparation, you can navigate this process smoothly. Steps to Apply for a Housing Loan1. Assess Your Financial SituationBefore applying, it's crucial to assess your financial health. Evaluate your credit score, monthly income, and existing debts to determine your loan eligibility.

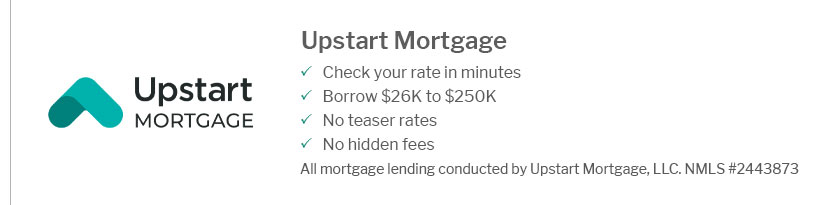

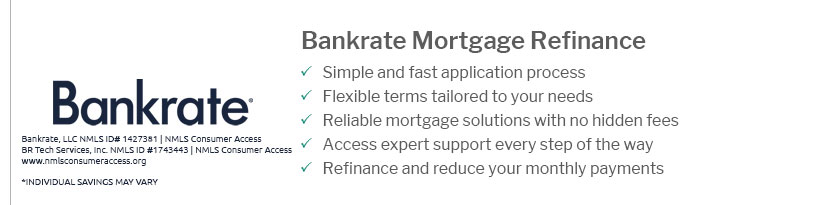

2. Research Different LendersOnce you understand your financial situation, research various lenders to compare their current market interest rates and loan terms. This will help you find the best deal tailored to your needs. 3. Gather Necessary DocumentationLenders require specific documents to process your application:

4. Submit Your ApplicationWith the required documents ready, you can fill out the application form either online or in-person. Ensure all information provided is accurate to avoid delays. 5. Await Loan ApprovalAfter submission, the lender will review your application and documents. This process may take a few weeks. If approved, you will receive a loan offer with terms and conditions for your acceptance. Tips for a Successful ApplicationTo enhance your chances of approval, consider the following:

Frequently Asked QuestionsWhat is the minimum credit score required for a housing loan?While requirements vary by lender, a credit score of 620 or higher is typically needed for most conventional loans. However, some government-backed loans may have lower requirements. Can I refinance my housing loan?Yes, refinancing can be an option to lower your interest rate or monthly payments. To learn more, check out how to qualify for refinance. How long does the loan approval process take?The approval process typically takes anywhere from a few days to several weeks, depending on the lender and the complexity of your financial situation. https://www.fdic.gov/consumer-resource-center/2022-06/applying-your-first-mortgage-loan

With a preapproval, a lender provides a commitment letter/document and agrees to loan you a specified amount of money to buy a home, subject to ... https://www.lendingtree.com/home/mortgage/how-to-apply-for-a-home-loan/

How to Apply for a Home Loan in 6 Steps - 1. Gather your financial paperwork - 2. Know basic mortgage loan requirements - 3. Choose the right mortgage type - 4. https://www.bankofamerica.com/mortgage/learn/how-to-apply-for-a-mortgage/

Once you find a home that meets your preferences, needs and budget (and the seller accepts your offer, of course!), it's time to apply for your loan. You'll ...

|

|---|